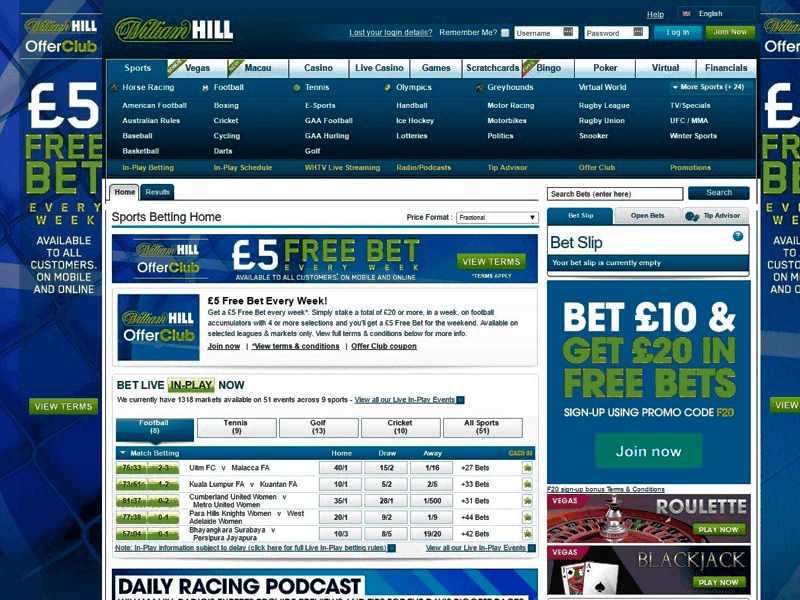

Why William Hill Betting is the Best One

The company was established by William Hill in 1934 during the period when gambling was unlawful in Britain. It has changed hands repeatedly, being bought by Sears Holdings in 1971, then by Grand Metropolitan in 1988, then by Brent Walker in 1989. In September 1996, Brent Walker recovered £117m of the £685m it had bought from William Hill when Grand Metropolitan was found to take control in an overstated way on the company’s profits at the very moment of the sale.

64 Betting houses of William Hill Betting

- Japanese investment bank Nomura mounted a £700m buyout of William Hill in 1997 when Brent Walker collapsed with debts exceeding £1.3bn after an investigation by the intense Fraud Office which saw two directors given prison sentences. In February 1999, the suggested trading flotation had been abandoned due to “weak interest” and Nomura offloaded the business to the financial resources managed by private equity companies Cinven and CVC Capital Partners for £825m as a replacement for it.

- The company was eventually listed on the London stock market in 2002. The subsequent year Chief Executive David Harding was awarded a £2.84m bonus, making him the UK’s fifth highest-paid company director in 2003. It purchased the Sunderland Greyhound Stadium in 2002 and Newcastle Greyhound Stadium in 2003. In June 2004, Chief Executive David Harding sold £5.2m of shares to fund his divorce, precipitating a decline within the company’s stock that wiped £75m off the price of the corporate. In 2005, William Hill has bought 624 betting offices in the places as such the United Kingdom, Republic of Eire, Isle of Man and Jersey from Stanley Leisure worth for £504 million: the achievement, in brief, took the company past Ladbrokes into first position in the betting market of United Kingdom in terms of outlets but not profits.

- The Office of Fair Trading persuaded William Hill in selling 78 Stanley shops out of the 624. Along with the concerns that William Hill had paid too much for the Stanley shops, the company was downgraded from the FTSE 100 Index in December 2005. In 2008, Ralph Topping was appointed Chief Executive. In November 2008, William Hill went into a collaboration with Orbis (latterly OpenBet), an Israeli software development company namely Playtech, to alleviate the company’s own failing online operation.

In accordance with the terms and conditions of the deal, William Hill paid Playtech’s founder Teddy Sagi £144.5m for various holdings and affiliate companies. These included numerous online casino websites which William Hill continues to work under the name WHG. Playtech took a 29% stake within the new William Hill Online entity. The corporate wrote-off a reported £26m when scrapping their previous in-house system. In June 2009 William Hill backed Playtech despite their partner having 1 / 4 of its stock market value exhausted following a profits warning. In 2012 William Hill acquired three small sports book operators in Nevada, which at the time was the sole state to supply full-service sports betting.